How to Efficiently Raise Funds for Your Medical Device Company

.png?width=4800&name=podcast_standard%20(2).png)

Are you in the midst of raising funds for a device that you are trying to bring to market? It can be challenging, and even more so due to the regulatory impact.

Jon Speer of Greenlight Guru and Mike Drues of Vascular Sciences share tips to consider when raising funds for your medical device. Put yourself in your investor’s shoes, and be capital efficient - focus on the right things at the right time.

LISTEN NOW:

Like this episode? Subscribe today on iTunes or Spotify.

Some highlights of this episode include:

- Putting together a regulatory strategy executive summary and pre-submission; pre-submission costs time and money to prepare, but is cheap insurance to minimize setbacks.

- Demonstrate that you know what you are doing and have the knowledge to run with the punches.

- Level of scrutiny, criticism FDA applies regarding medical devices has changed.

- Types of investors and what they all want: Make money and minimize risk.

- Different regulatory events serve as key milestones for companies to raise funds.

- Fast majority of submissions are rejected by FDA the first time through.

- Some companies are reckless and haven’t performed proven engineering or design controls; sync clinical data requirements with human factor requirements.

- If a company has limited resources, it has to choose what to put money into (prototype, quality management system, etc.) to grow the company.

Links:

Pre-Submissions and Meetings with FDA Staff

Memorable Quotes by Jon Speer and Mike Drues:

“A lot of companies are in the throws of fundraising at some level.” - Jon Speer

“This regulatory strategy is really foundational to the company’s success.” - Jon Speer

“Every investor wants to do two things: Make money and minimize their risk.” - Mike Drues

Transcription:

Announcer: Welcome to the Global Medical Device Podcast, where today's brightest minds in the medical device industry go to get their most useful and actionable insider knowledge, direct from some of the world's leading medical device experts and companies.

Jon Speer: I know a lot of you who listen to the Global Medical Device Podcast are in the midst of raising some sort of funds for a device that you're trying to bring to market. And there are a lot of, of course, trials and challenges and tribulations in the effort to raise fund raising. And one of the biggest challenges or obstacles in that is that regulatory impact, how does it play into the big picture of your ability to successfully raise funds? What certain milestones do you need to have completed? Do you need to do a 510(k) in order to get additional sources of funding? On this episode of the Global Medical Device Podcast, Mike Drues from Vascular Sciences and I talk a little bit about some of the things and strategies and tips that you should consider in your efforts to raise funds for your medical device.

Jon Speer: Hello and welcome to another exciting episode of the Global Medical Device Podcast. I'm really excited about this particular episode. It's something that I have had a lot of thoughts about for a long time, but honestly, I haven't really spent much time with the podcast or any other content on exploring this. And I'm excited today because I have Mike Drues. Mike is the President of Vascular Sciences and when I kinda pitched this idea to him, recently, he was equally excited. So Mike, first of all, welcome to the Global Medical Device Podcast.

Mike Drues: Well, thank you, Jon. Always a pleasure to speak with you and your audience.

Jon Speer: Alright, so let me hit you with a question and then I think once I hit you with this question, you'll recall [chuckle] the topic that you and I loosely chatted about recently but... And here's the question, if I'm a company, maybe specifically a startup or a company that's in the throes of raising funds to further my medical device technology. What information should I have when I'm seeking that funding? So I'll start with that open-ended question and get your initial thoughts on that.

Mike Drues: Well, that's a great question, Jon, and a terrific place to start out this discussion. Here's a quick statistic to just share with your audience. And that is here in the United States, 80% of medical device companies have 50 or fewer employees. I'll state that one more time, 80% of device companies have 50 or fewer employees. So this industry is fraught with very, very small companies and indeed startups who are looking to raise money, either for the first time or raise money for future projects from friends and family, from Angels, from VCs, from SBIRs, from a number of different sources, potential corporate investments. And like you, Jon, I work with companies in all of these different places. And one of the first things that they usually do when they come to me is they want me to put together what I call a regulatory strategy executive summary. And it's not a full-blown regulatory strategy, it's a summary of all of the different options they have and the advantages and disadvantages in order to get their product on to the market.

Mike Drues: And the reason why they wanna do this, Jon, is because they wanna take that information and usually boil it down to one or two PowerPoint slides that they can put into their investor package, so that when they get to their Angel or VC or whoever it is that they're gonna be talking to for money. There's really two things that they want to demonstrate. The first is that they know what they're doing. In other words, they know what all their different options are. Not just the vanilla flavored ones, but all of the different options. And that, quite frankly, is the easy part. The second part that they need to demonstrate is that they, meaning, the team, they have the knowledge and the experience to roll with the punches. Because as you know, Jon, the regulatory world is a very fluid place. It's constantly changing.

Mike Drues: And just as a quick example, there are many medical devices that have gotten out to the market here in the United States in the past under the 510(k), say, 10 years ago or even five years ago. But if the same device with the same submission came to the FDA today, it might not get through. And so the question is, why? Has the regulation changed? Well, no, in my opinion the 510(k) regulation changed... Sorry, the 510(k) regulation has really not changed since it was created in 1976. But what has changed is the level of scrutiny or criticism that the FDA applies to those certain parts of the submission, and that's a little beyond the scope of this discussion to get into. But, those are two things that potential entrepreneurs or companies looking to raise money, those are really things I think that are very important to demonstrate to potential investors before they sit down and start to... And sign the check.

Jon Speer: Yeah, those are really good points and I... It is surprising, but folks really, if you're 50 employees or less, you're in the majority when it comes to the medical device industry. And I think that blows a lot of people's minds that... 'Cause we think of the big names a lot when we think of the medical device industry. But the startup, the smaller entity, is definitely the majority in this space. And to Mike's point, a lot of companies are in this kind of throes of fundraising at some level, whether it's bringing your first product to market or you've got additional devices that you're exploring or looking for some bridge funding and that sort of thing. And my first exposure... I guess let me give you a kind of a short timeline of my history, over 20 year history in the medical device industry.

Jon Speer: I first started working for one of these larger medical device companies, one of the minority if you will, from the industry. And I really didn't have any exposure to the startup world in the medical device space, until many years later, and once I got exposed to that it was fascinating to me and fascinating because this regulatory strategy is really foundational to the company's success. You hit on a couple of things. They have to demonstrate, of course, they know what they're doing. They have to try to demonstrate some sort of, quote, certainty as far as getting the product to market. And we'll talk a little bit about that here in a moment. But then also making sure that they've got the right team. And this is one of those things that's very challenging, because Mike, what does every investor wanna do?

Mike Drues: Every investor, I think, Jon, wants to do two things. They wanna first of all make money.

Jon Speer: Yeah.

Mike Drues: But second of all, they wanna minimize their risk...

Jon Speer: Right.

Mike Drues: In every sense of the word. So those are a couple of things that I think investors want to do.

Jon Speer: Yeah, I agree with you. So when you talk about medical device industry, making money, hopefully there's some altruism that plays into the decision as well, being able to help save lives or improve lives, but getting that product to market is a time-consuming thing. An average device could easily take multiple years before it gets to the market. So the making money part is challenging because now it's lengthened, so that's important. And then de-risk or some path of certainty is also challenging because, to Mike's earlier point, we're dealing... In the medical device industry, we're dealing with regulatory agencies, groups like the FDA, where there isn't certainty per se. And so I think... And when I first got exposed to this, about a dozen or so years ago, it became fascinating, because there are a lot of different regulatory events that I saw as kind of the key milestones and times when companies would be able to successfully raise funds. So I don't know if you've seen the same thing in your world.

Mike Drues: I have Jon and I would add one other thing, that I almost always include as part of that regulatory strategy executive summary and this goes along the lines with de-risk. As you and I have talked about many times in the past, Jon, the vast majority of submissions to the FDA, 510(k) s, De Novos, BMAs and so on, the vast majority of them are rejected first time out of the box when they're submitted to the FDA. So another thing that I include, and you can probably guess what this is going to be, Jon, is a pre-sub. Because it's amazing to me how many companies will go to a potential investor... And I spend some of my time working as a consultant for Angel and VC groups, helping them do regulatory due diligence. So I see this from both sides. They'll come in and they'll say that, "Our device is 510(k) Class II and we're gonna do a 510(k) and it's gonna get done in X number of months." And so on. But that's a huge assumption. A huge assumption.

Jon Speer: So I encourage a lot of companies, virtually all the companies that I work with, especially at the very early stage, to put a line item in their budget for time and for money to prepare for the pre-sub. Because the folks in the company, we can have a discussion from now until the sun burns out in terms of how we're gonna bring our device through the FDA, but until we take it to the FDA, it's purely hypothetical. And so I would rather be in a position to say to a potential investor that we're also planning on taking this to the FDA as a pre-sub to present it to them to make sure that we're all on the same page, we're all pulling in the same direction. And then after the pre-sub, Jon, I use that pre-sub meeting as a huge advantage when I go to talk to investors because now we can say we've already had a discussion with the FDA and, yes, although things can change, here's what we've agreed upon. We've gotta do A, B and C. Each thing is gonna take this amount of time and cost this amount of money. So, at least in my view, Jon, that adds tremendous credibility to the discussion with any, either new or existing, investor.

Jon Speer: No, it's a really good point. And the pre-sub, as you and I have talked about a few times in the past is a, I'll say, relatively newer program at the FDA. And I like the strategy there because... Well, let me go back in time a bit. So, about... When I first got exposed to medical device startups about, like I said, about 12 or so years ago the classic, the classic, regulatory event that was used as the milestone for a funding opportunity was a 510(k) submission and that confused me, because to Mike's earlier point, just because you submit a 510(k) to FDA there's not certainty there, in fact to the later point Mike made, the vast majority of 510(k) s, I think it's like three out of four 510(k) s get rejected the first time. So, how in the world... This blew my mind... How in the world could a startup company use a 510(k) submission as an event that was meaningful when one out of four of those is gonna be successful? From an investor point of view that is not certainty. That is not eliminating or reducing risk. But yeah, historically it's always been the classic regulatory event for raising money. And that never made much sense to me.

Mike Drues: Well, Jon, it's a very valid point and I agree with you, but on the other hand, we have to be a little bit careful that we don't overgeneralize investors. There is a lot of different types of investors. So for example, the types of investors that you're describing, those that would invest in a company after a 510(k) has been cleared or a De Novo granted or a BMA approved, those are very risk averse investors. Those are the investors, typically you're talking about a large medical device company, for example, that's looking at acquiring your technology. It's already pretty much done and they're just gonna add it to their portfolio with their other products. There are other types of investors, for example, who are willing to get in much, much earlier in the game, to start to invest at the point of a prototype or perhaps even before there's a prototype, and those types of investors obviously understand that the 510(k) or whatever kind of a submission that you're gonna be doing to the FDA, that's still pretty far down the road. So again, I think we have to be a little bit careful that we don't use the word investor in a too ubiquitous of a fashion.

Jon Speer: No, that's a good point. It really is a good point. And I guess what I've seen in this, in my time in this industry, that the I'll guess the overall medical device industry investor confidence has kind of been up and down, up and down, and I guess I'm curious if you have your finger on the pulse of what the investment situation is like today in the medical device industry. But there have been times where there's been a lot of dollars that are going into startups and I really love the idea of the pre-submission. This is, folks, number one suggestion if, or maybe there's a few here, but developing that regulatory strategy is key, but also getting to a point where you've already been in front of the FDA with a pre-submission. It doesn't... There are levels to this, of course, depending on what it is that you're doing. But you could get to a pre-submission discussion with FDA for a relatively reasonable amount of funding. You might need to get some friends and family money. You might need to get a little bit of seed capital. But if you believe in the technology that you're doing and you can show and demonstrate that it has merit in the marketplace and you've got the right team together, there's no reason why you should not prepare that pre-submission and have that discussion with the FDA. It's only going to help build your case as you need additional rounds of funding and additional milestones that you and your team are going to achieve.

Mike Drues: Well, once again, Jon, I could not agree with you more. To dig into that just a tiny bit further. I've had several situations now where we've gone to the FDA with a pre-sub so early in the process we literally have a prototype, or in some cases we do not even have a prototype yet. So the question becomes, why would a company want to do this so early in the game? I've done this a number of times. The answer is very simple. They don't really care about getting FDA's agreement on regulatory strategy or testing methodology or whether or not clinical data is important, as we would in a traditional pre-sub. That's not their primary motivation. Their primary motivation is, as I said earlier, to establish credibility with potential investors, to be able to go to a potential investor and say, "Look we've already had a meeting with the FDA, and yes things can change, but here's what we agreed on. Now, I'll be honest, Jon, not all potential investors put value on that, but many of them do. So for those in the audience that are looking to raise money from potential investors, this is a strategy that I think they should think about. And to the point of cost, at least for the moment, Jon, as you know, there's no user fee for the pre-sub process, but give Congress a little bit of time. I think they're missing a huge opportunity here to make money.

Mike Drues: So, in terms of the cost out of pocket to the FDA, a pre-sub is free. That said, obviously it does take time and money to prepare for the pre-sub, but I look at it as cheap insurance. I look at it as really minimizing the probability of problems and delays and setbacks in the future.

Jon Speer: No, that's a really good point. Now, Mike, I'm gonna share one of my pet peeves and I'll explain why it's a pet peeve but I hear this... Oftentimes I hear this phrase, first in human, as a meaningful event or milestone from... And primarily I hear it a great deal from startups, and I hear it as sort of a trigger event for the ability to raise additional funds, and I'll be honest, sometimes that irks me. And let me explain why it irks me. It irks me because a lot of these companies that are touting this first and human path what I've observed, what I've seen, what I've learned from a lot of these companies, in my opinion, they're very reckless. And what I mean by that is they haven't done prudent engineering, they haven't focused any on design controls, and risk of that particular product or technology that they're developing. They haven't done their due diligence on the technology. It's like a race to try to get into human studies. And these companies are going all over the world, India, Ukraine, all these different places where there is a more lax regulatory environment and that just drives me crazy. So I don't know if you have any opinions on that.

Mike Drues: Well, of course, Jon, I do. You know, I do. Listen, I'm not even gonna touch on the phrase prudent engineering. And by the way, thank you for reminding me of my phrase that I usually use when I talk about design controls. Obviously, a company and the people in it have a responsibility to do prudent engineering. That to me goes without saying. The question that you're raising is the necessity for clinical... Data for human data, and first in man trials and so on. This is another area that I work a lot in. But once again, we have to be careful that we don't overgeneralize. Let's remember that the vast majority of medical devices out there, certainly the bulk of the 510(k) products do not require clinical data, at least to get them through the FDA.

Mike Drues: Now, another thing a lot of people don't realize is that there's a litany of reasons why a company might need clinical data or need to do a clinical trial. FDA is only one of them. I've been involved with several devices where we were 100% confident that we could get the product onto the market, that is through the FDA, without any clinical data, but we also knew that there was not a snowball's chance in you know where that we would get it onto the market without any clinical data and get reimbursement for it. Or we would... We knew that physicians wouldn't need it. This is a problem of clinical... Sorry, physicians wouldn't use it. This is a problem with clinical adoption, without any clinical data.

Mike Drues: So if you're going to have a discussion about the necessity for clinical data, the first question you have to ask is, why are you collecting that data? But again, in terms of investors, I think clearly, to be able to demonstrate to early investors that you have a strategy to support whether or not your device needs clinical data and if you do why? For CMS or health economic reasons, is it for clinical adoption reasons, is it for something else but usually the money for that is gonna come much, much, much later because it might be a pretty big chunk of change that you're looking for it to do a clinical trial determining... Depending on the time and the number of patients and so on.

Mike Drues: And one last thing now that I think about it, Jon, I would encourage your audience to consider is possibly to try to sink or overlap your clinical data requirements with your human factor requirements because in more and more medical device applications, there's really no difference between a clinical trial and a human factor study. So you really have to take a holistic approach and you really have look at... Get all of your ducks in a row and have a well thought out plan. Just like you would have a well thought out plan to go to the FDA with a pre-sub, you have to have a well thought out plan to go to a potential investor before they're gonna be willing to sign the check.

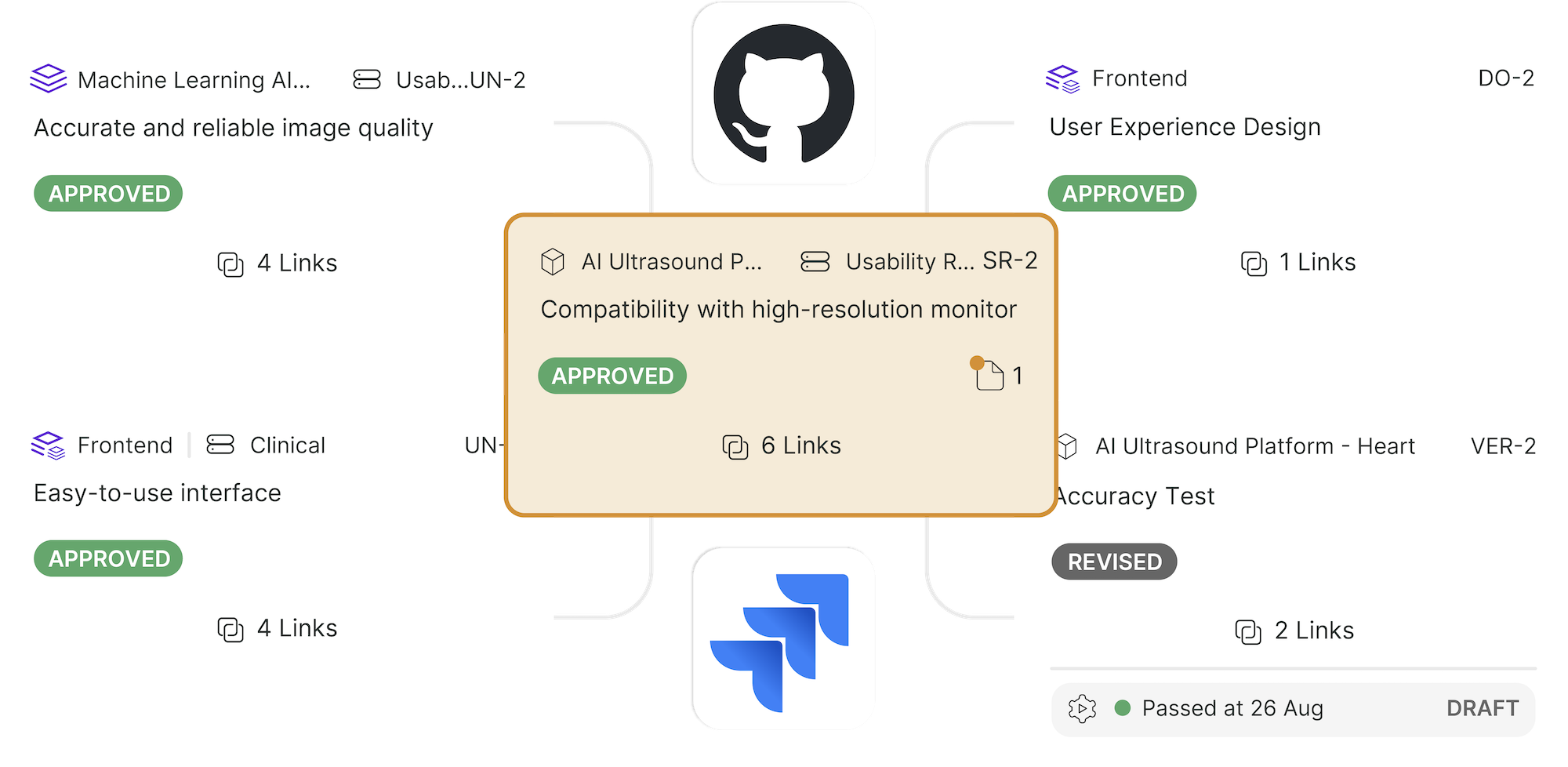

Jon Speer: Excellent, excellent points. Ladies and gentlemen I'm talking with Mike Drues, President of Vascular Sciences, and today Mike and I are diving into some topics around when companies might be able to seek investment funding and providing some tips and pointers on things that you should do. And certainly we've touched on things like the importance of a pre-submission and certainly a regulatory strategy and how if you're pursuing first in human studies that that should be a holistic approach. It should align with the topic of human factors and how you plan to address that as well as things like reimbursement, that it should all be a holistic plan and approach and it should be very purposeful as you go along. Now, Mike, one thing that we pride ourselves at Greenlight Guru is that we've built this EQMS software platform and we have specific workflows that are designed for managing and maintaining design controls and risk management.

Jon Speer: And the reason I wanna bring that up, is we have a customer of ours, actually, this gentleman has... He is an investor. He has actually purchased Greenlight Guru for three companies that he works with over the years. And he's quite the character. His name is Ronnie Bracken. He used to work at CR Bard and he used to work in their mergers and acquisitions area several years ago. And he shared this story that they would go in and look at startups who are trying to get their product to market, or get acquired, or whatever the exit strategy would be for the company. And they would evaluate these technologies. And one of the things that he would say when he'd go and look at a company and they didn't have proper design control documentation, they didn't have proper risk management files, they hadn't done their prudent engineering, they didn't have solid regulatory strategies, sometimes, that was an exciting opportunity from his M&A position, because they were able to go in and basically reduce the valuation of that company because now CR Bard and their M&A activities was going to be basically not only acquiring the technology, but the risk along with that. And he used to talk about giving companies a $20 million haircut on their valuation because they hadn't done proper design controls and risk management.

Jon Speer: So folks, the reason I bring this up is, as you're building your case, at every step along the way you have to consider that these things like design and development, design controls, design history file, risk management file, they are prudent engineering and they will improve the value of the thing that you're doing. So don't forget about those things.

Mike Drues: Well, Jon, I agree with you completely. Obviously, you're preaching to the choir, but let me turn this around and ask you a question. So thus far, we've talked primarily from a regulatory perspective, what the advantages are of considering your regulatory strategy, pre-sub and so on before going on to investors. But what about from a quality perspective? One of the questions that I get from a lot of my customers, Jon, and I'm sure you do as well, is how early in the development process should we start thinking about all of those quality issues that you just mentioned, all of that documentation.

Mike Drues: Now, let me be honest, in an ideal world, it would be very, very simple to just simply say, "Well, we should begin with all of those things from the very beginning. From the very initial stages of product development we should have a robust and fully developed quality system in place." But at least in my experience, Jon, that's not a very pragmatic solution because when a company has limited resources, you literally have to choose what to put your money into to be able to grow the company; whether it's developing a prototype, whether it's going to the FDA and so on. So what would be your thoughts, what would be your best advice on how to incorporate those very important quality design controls, documentation kind of issues, keeping in mind that maybe the company doesn't have a lot of resources at the very beginning to do that?

Jon Speer: Mike, I'm so glad you asked that question because those of you listening, who know anything about my passion around quality management systems, you'll appreciate... Hopefully, you'll appreciate my opinion on this and my experience on this. And Mike, I actually liken this topic of when do you build a QMS and how do you build a QMS? I actually liken it, there's a lot of parallels to funding of a company. And I use a phrase "bootstrap your quality management system" and "bootstrap" is oftentimes a term that's used when we are raising funds for a new technology. And what I mean by that is, build it as you go, build it as you need it. And if you're a startup that's just developing a device, you don't need to focus on a full QMS and if you're talking to a consultant or somebody that says you need to have the entire QMS in place to comply with FDA 820 and ISO 13485 and so on and so forth, my opinion is that they're misleading you a bit. And here's what I mean by that. When you're in design and development, there's about a handful elements of the quality management system regulations that you need to be focused on. You're in design and development. So design control, absolutely is something that you need to address. Your risk is part and parcel with design and development these days so have a process in place that addresses ISO 14971 and it is a holistic approach from a risk management standpoint.

Jon Speer: There's a good chance that you will be generating documents and records. Absolutely, you'll be generating documents and records so make sure you have a process that describes and defines your document management processes. And then a common thing for many companies these days, we use this term virtual company, and that implies that you're probably gonna be outsourcing different things, whether that be design services or testing services or pilot production and manufacturing or whatever the case may be, you're gonna be outsourcing to suppliers. So make sure you have a supplier management process in place. So design control, risk, document management, supplier management.

Jon Speer: And in my opinion, that's probably all you need from a quality management system for up until the time that you're preparing for clinicals and maybe even a little bit beyond that. So as you prepare for some of these more advanced design and development activities like building clinical units or getting into more of a production setting, then you'll build additional parts and pieces of your quality management system as you go. But build it as you go, that's my philosophy. Make sure that your QMS is bootstrapped and right-sized based on the stage of where you are.

Mike Drues: Well, I love that advice, Jon, build as you go or bootstrapping or however you wanna describe it. Shakespeare said, "A rose by any other name still smells as sweet." So I agree with you, this is a strategy that I've used many, many times in the past myself. As a matter of fact, to take what you said just a half a step further, Jon, oftentimes, I do get invited by entrepreneurs and small startup companies to help them develop their presentation for their investors, or in some cases, actually participate in the presentation and the discussion itself. And when it comes to the quality issue, I will say, look, we all understand that quality is important, but as Jon said, he's the guru when it comes to quality, hence, the name of the company. As Jon said, we don't have the resources to implement a full blown, robust quality system right now. As a matter of fact, we don't have a product right now, so it's a little bit like putting the cart in front of the horse. But we do think that's very important. We do think that we need to be able to do all of those things and we do think there are things that we can do right now in order to ease the transition as our company grows, when we have to put those systems in place, or if our company gets acquired by one of the big guys, and then we have to move our system, our documentation into the larger company's QMS.

Mike Drues: So what I like to do, Jon, and this is just a different spin on what you just said is I'll triage the elements of the quality system. We'll start out with the most important ones in order to be able to make that transition further down the road much easier. And again, this is demonstrating to the investors that just like when I try to demonstrate this to the FDA, that we know what we're doing, that we know what all of the steps are involved, that we know what all of our options are and we have evaluated our options and given where we are right now in our product development process, given where we are right now in the life cycle of the company, given where we are right now in terms of the resources that we have, these are the things that we're focusing on now. And then these other things we will focus on later as we get further down the road. That's my approach to the quality side, very similar to the regulatory stuff.

Jon Speer: Yeah, it's just good advice, folks. Be focused on what it is that you're trying to do. And, of course, have enough foresight to know what's coming, what's coming down the road. But you've got a finite amount of time, you've got a finite amount of resources, you've got a finite amount of capital, be capital efficient. Make sure that you're focused on the right things at the right time. Very, very important. Hard to do, but very important to do. So, Mike, as we wrap up this discussion today, is there, I guess, one big tip that you wanna leave folks with or a horror story or some sort of... [laughter] Some sort of tidbit that you'd like to share as we wrap up today's conversation?

Mike Drues: Well, rather than a horror story, Jon, let me try to leave on a positive note. So here's my biggest piece of advice, just like when I have discussions with companies prior to going to the FDA, I ask them, "What would it take for you as an individual to put your stamp of endorsement, if you will, on your device to say that my device is okay to use in a family member and a friend and perhaps, even myself, or in my case, my two and a half year old grandson?" I would apply the same logic to an investor. Put yourself in the investor's shoes. So, what would you, as an investor, need to see in terms of the technology as well as the team in order to convince you to sit down and write the check? If you've put together what you think is a strong argument as to why your technology is beneficial, why your team has the experience to do what you're saying that they will do, and you can walk in there with confidence, I think you're in good shape. So that would be my... It sounds very simple, sounds very basic. And in fact, it really is, but at least in my experience, Jon, it's amazing to me how many people don't do that. So that would be my final piece of advice to leave our audience today.

Jon Speer: Well, that's a good piece of advice. And Mike, I wanna thank you so much once again for participating in this conversation on the Global Medical Device Podcast. And folks, as I mentioned earlier, as you're exploring this path, this journey if you will, on bringing your products to market, whether you're a startup or an established company who's already been through this, I would encourage you to focus on true quality. And I don't mean that in a classic interpretation of quality like quality systems, but you have to think about each of us as a medical device professional, we do have a responsibility. We are developing medical devices that are going to save and improve the quality of life and there's... Think about the big Q Quality, the things that we need to be doing at various stages during the design, develop, and manufacturing and sale of our products. Keep focused on that, make sure that you're constantly evolving your approach and your systems to make sense. Don't just focus on the compliance check box but make sure the things that you're doing are prudent and appropriate and applicable to the stage of where you are.

Jon Speer: And if you wanna learn a little bit more about how Greenlight Guru is changing and improving the focus of quality, within medical device companies in over 35 countries and 500 cities around the world, I would encourage you to go to www.greenlight.guru to learn more about our exciting award-winning EQMS software platform designed specifically and exclusively for the medical device industry. So you all have been listening to the Global Medical Device Podcast, as always, this is your host the Founder and VP of Quality and Regulatory at Greenlight Guru, Jon Speer.

ABOUT THE GLOBAL MEDICAL DEVICE PODCAST:

The Global Medical Device Podcast powered by Greenlight Guru is where today's brightest minds in the medical device industry go to get their most useful and actionable insider knowledge, direct from some of the world's leading medical device experts and companies.

Like this episode? Subscribe today on iTunes or SoundCloud.

Nick Tippmann is an experienced marketing professional lauded by colleagues, peers, and medical device professionals alike for his strategic contributions to Greenlight Guru from the time of the company’s inception. Previous to Greenlight Guru, he co-founded and led a media and event production company that was later...