2025 Medical Device Industry Benchmark Report

In our sixth annual medical device industry report, we surveyed more than 500 professionals to pull back the curtain on the medical device industry and show you exactly what your peers and competitors are going through right now—the challenges, opportunities, and goals that medical device companies have in front of them this year.

Download the full reportTop Takeaways

Economic pressure is high

Changing regulations are leaving pre-commercial companies behind

As businesses grow, so do silos

Companies are stuck in outdated tech

Who took the survey?

Over 500 industry professionals shared their voices, priorities, and biggest hurdles in the medical device industry for 2025.

Reality-check development timelines

Many pre-commercial companies misjudge the time and complexity required to bring a product to market. 64% of pre-commercial companies developing Class II/III devices anticipate a six-year-plus timeline, yet only 29% of companies that have successfully launched products actually needed that long.

Overestimating development timelines can lead to inefficient capital allocation, while underestimating regulatory and operational hurdles can result in costly delays. A more realistic approach, informed by data from companies that have successfully launched, is essential for better planning and execution.

Bridge leadership-employee gaps

A disconnect exists between leadership teams and operational staff when it comes to priorities. 55% of non-leaders identify submission timelines as a critical performance metric, while only 40% of executives share the same view.

This gap in prioritization can create misalignment, slow down product launches, and introduce inefficiencies. Ensuring leadership and employees are aligned on key objectives will lead to a more effective strategy for meeting regulatory deadlines and accelerating market entry.

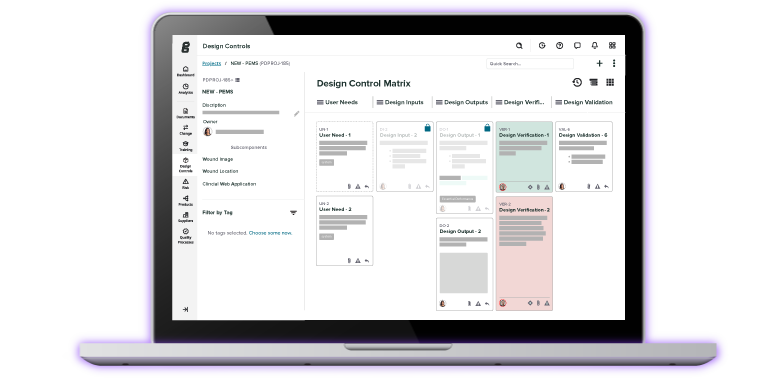

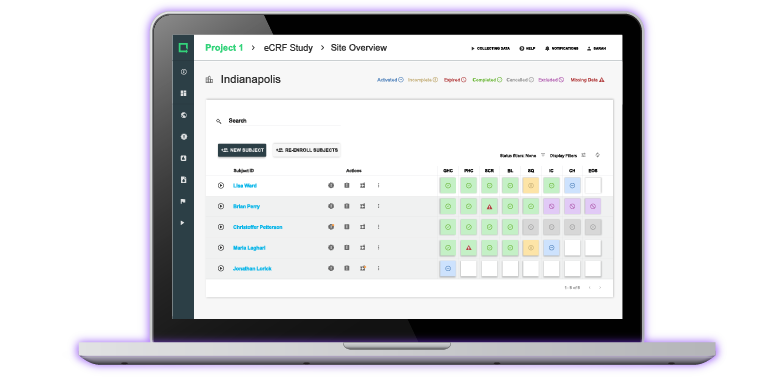

Leverage industry-specific tools

Companies that use purpose-built quality management solutions are twice as likely to meet their quality goals compared to those relying on generic tools.

Despite this, 56% of companies still use paper-based or general-purpose tools for clinical data collection, and 69% are not confident that their current QMS can support projected growth.

Industry-specific software streamlines compliance, improves collaboration, and reduces the risk of regulatory setbacks, allowing companies to scale effectively.

Eliminate data silos

Data silos remain a major barrier to operational efficiency, affecting everything from quality management to regulatory compliance. 62% of large companies report struggling with siloed data, which limits cross-functional collaboration and slows decision-making.

Companies that report being highly collaborative are six times more likely to meet their quality objectives, demonstrating the importance of breaking down silos.

Implementing integrated digital solutions enables better data flow, enhances AI-driven insights, and improves overall business agility.

Make quality a competitive advantage

Companies that view quality management as a strategic asset rather than a regulatory burden set themselves apart in the market.

Organizations with strong quality systems are twice as likely to meet their compliance goals, and yet 43% still rely on outdated tools for quality management. A strong focus on compliance and continuous improvement not only ensures regulatory approval but also builds long-term credibility and trust.

By embedding quality into every stage of product development, organizations can turn compliance into a driver of innovation and competitive differentiation.